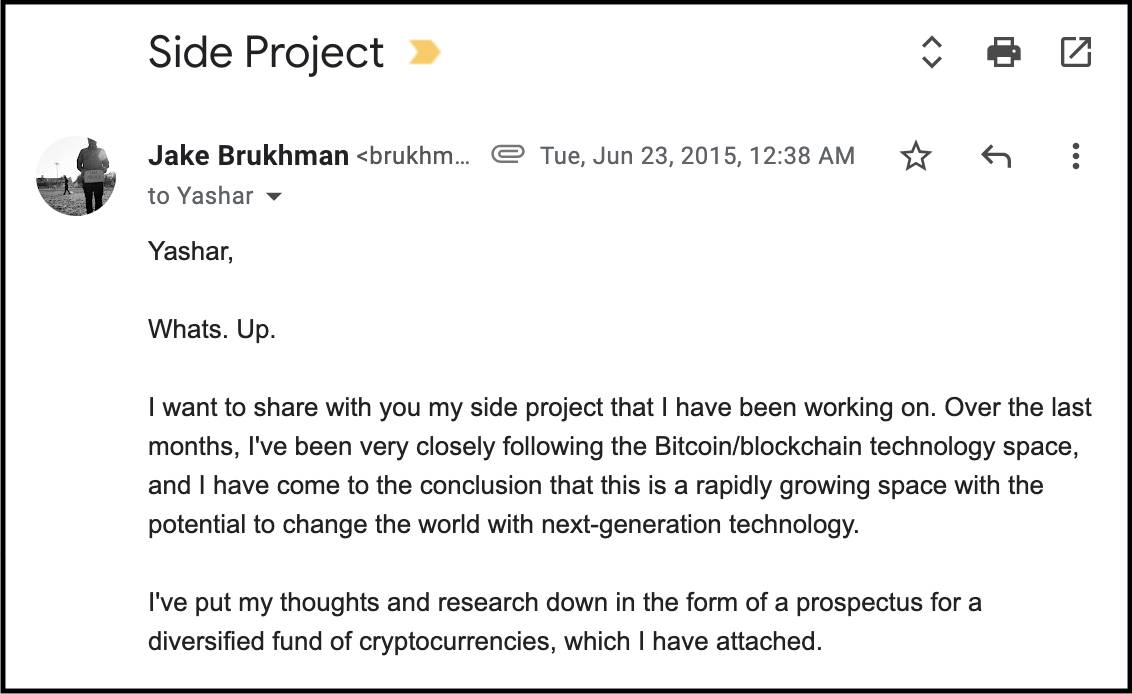

The blockchain technology space proceeds in cycles. Today, in July of 2022, we are in a downturn but with more reasons than ever to be excited about the future. July 1st marks seven years since CoinFund was founded at my kitchen table in Williamsburg, Brooklyn, in the 2015 Bitcoin bear market. Indeed, as a firm we spent four and a half of the last seven years navigating bear market conditions. Now, as we begin our eighth year as a firm, it’s worth reflecting on just how far the industry — and CoinFund — have come in that time.

The Wild West of 2015–2016

Thinking back to July of 2015, it’s hard to exaggerate how different things looked. Bitcoin was trading around $250, down from its last high of $1,200. This was thanks to the collapse of the Mt. Gox exchange the previous year, an event that shook our nascent industry to its core. Ethereum was still a month away from mainnet launch and “dapps” (decentralized applications) were not much more than theoretical blog posts and a few toy-like demos on testnet. CoinFund’s very first research articles, which started to be published in June, made barely any reference to smart contracts at all. At that time, we saw the world mainly through the lens of “cryptocurrencies” and smart contracts were an abstract idea for most participants in the space.

The top-ranking “altcoins”, as new tokens used to be called by skeptical Bitcoin proponents, included some familiar tickers like XRP and DOGE but also token issuance platforms like BitShares, NXT, and Counterparty, which have since joined the annals of history. The cryptocurrency exchange market consisted of a small handful of operators, boasting the kind of UX that required a serious leap of faith and technical skills on the part of the user. The idea of institutions getting involved in crypto seemed a distant future fantasy, if not wholly unrealistic.

Nevertheless, there was an abundance of opportunity in the early innings of that down market. CoinFund was founded in order to define a new kind of investor for a new, disruptive technology industry and as a firm, we chose to be community-oriented, hands-on, and data-driven for our founders, helping them to navigate the challenges of new markets. We began to study this wholly new asset class from first principles. We have been and continue to be on a mission to get blockchain technology broadly adopted in practical and responsible ways, while fighting to preserve the key, highly impactful value propositions of crypto networks.

When Ethereum finally launched in August of 2015, CoinFund was likely the only modern crypto fund to have mined some of the first blocks on Ethereum Frontier mainnet. To this day, CoinFund continues to be a highly entrepreneurial and multidisciplinary team who are full stack problem solvers for their portfolio projects and who remain deeply involved as participants in decentralized networks.

By early 2016, the market began to pick up. Ethereum launched Homestead, the second production release of the mainnet, in March. This would turn out to be the starting pistol on the ICO craze that would come to characterize the industry’s next bull cycle. CoinFund’s 2016 Year In Review detailed some of the exciting developments that year, including some of our (perhaps overly) hopeful outlook on dexes and decentralized social media for 2017.

The 2017 ICO Boom and the two-year Crypto Winter

The ICO Boom of 2017 saw a dramatic critical mass of cryptonative fundraising (and euphoria). Though it was a bubble, in retrospect much of the capital crowdfunded in this stage of the market was rotated to other areas by retail investors and supported some very important projects that would subsequently form the basis of the DAO, DeFi, web3, and NFT verticals.

Bitcoin ended up becoming the hottest topic around the Thanksgiving dinner table in 2017 and would go on to reach a new all-time high of $20,000 that year. November was also the time that CryptoKitties, the first popular NFTs, famously clogged Ethereum and pushed public awareness more than ever before to blockchains. Although the bull market was fueled by retail speculators, December 2017 marked another important milestone in crypto history: it was the month that the CME launched its first regulated Bitcoin futures offering, opening up the markets to institutional participation.

However, the subsequent 2018 and 2019 period became a brutal bear market and has come to be known as the Crypto Winter. The CoinFund team took this opportunity to practice investing discipline, encourage our founders to have long term focus, and support them as they built blockchain’s critical infrastructure.

During this time, we made early investments into some of our most successful companies across important blockchain verticals. To name just a few, we became an early investor in Blockdaemon, a major blockchain infrastructure provider that has since grown to be a multi-billion dollar firm. We funded the first round of Ceramic Network, and the strategic round of The Graph, knowing that web3 infrastructure would play a critical role in dapps. We also invested in Dapper Labs, now a key player in the NFT and Metaverse arena, which was just starting to plan its Flow blockchain strategy at that time.

Throughout 2019, CoinFund led the industry in active network participation, the idea that cryptonative funds investing in crypto networks should not only be giving teams capital, but engaging the networks themselves. By adding liquidity, running validators, and participating in the governance processes of networks, we argued that funds would increase the network’s prospects for success while creating competitive and differentiated returns for their LPs. CoinFund’s market outperformance during this time is partially explained by software mining Livepeer, governance arbitrage on DigixDAO, and running validators on portfolio networks such as Polkadot and Harmony in exchange for staking rewards. Today, active network participation is par for the course in cryptonative strategies, and there are more institutional market making and network engagement activity than ever before.

By the end of the Crypto Winter, it was evident that the blockchain sector was at the dawn of a vigorous recovery, having made substantial progress on putting in place the infrastructure that would enable better throughput, interoperability, governance, and usability.

The 2020 crypto bull market and onwards

The Coronavirus Crash in March of 2020 gave crypto investors a momentary shock, but crypto proved to be more resilient to the COVID pandemic than the greater economy and recovered quickly. What followed in quarantine was a boost to all digital technologies, and we saw subsequent bull markets in the DeFi Summer of 2020 and the NFT Boom of 2021.

The seeds of the DeFi movement, which had been sown by early projects including Maker, Compound, and Uniswap, began to flourish, and the value locked in DeFi shot up from $1 billion to $200 billion. But DeFi didn’t really take off until the advent of liquidity mining, a system first launched by Synthetix, who credits CoinFund and its portfolio companies for the early ideation in this area.

Indeed, we think our portfolio company Balancer was one of the first in the industry to launch liquidity mining, and Rarible was the first non-DeFi project to launch such a program for their NFT marketplace. The NFT craze also took off in earnest in early 2021, with Beeple’s record-breaking $69 million NFT art sale through Christie’s making headlines worldwide. NFTs being mentioned on Saturday Night Live was truly a pivotal moment of early mainstream adoption of blockchain technology in the United States.

Given the acceleration in the crypto markets, it should be no surprise that 2020–2021 was a period of substantial growth for CoinFund. We had noted the increasing appetite for NFT-based art in late 2019, and predicted a huge future for NFTs in segments such as gaming, real-world assets, and property assets. In September 2020, we wrote that all digital assets were going on-chain as NFTs and about our investment in Rarible. We’ve also put further investment into Dapper Labs, along with new investments in NFT projects such as Upshot, Cryptoys, and NFTfi.

During the last few years, we’ve also expanded our portfolio across other major cryptonative verticals. In the web3 stack, we’ve made infrastructural investments like API3, and Polywrap, and web3 network investments like GIANT Protocol and DIMO. In DeFi, we’ve backed Union Protocol and Opyn. In DAOs, we led the seed round of Orca Protocol and were in the first round of Syndicate.

In 2021, CoinFund closed a third seed fund worth $83 million, which made 28 investments in 10 months, taking lead positions in 17 of them, about 60%. We also established a joint venture collaboration with Metaversal to focus on the NFT vertical. CoinFund is Metaversal’s initial investor and strategic adviser, supporting it in the production, curation, and investment of iconic NFT projects. Today, Metaversal is a 20-person company with $50 million on its balance sheet.

Finally, we are constantly on the lookout for how blockchain technology will interact with other technological verticals in the future. In 2021, we became one of the first crypto investors to do work on the intersection of blockchain and artificial intelligence with Evan Feng leading our investment in GenSyn.

Looking forward, the most amazing observation about blockchain technologies is that after over a decade of building essential infrastructure, much of the growth and adoption remains ahead. The most mainstream adopted vertical, NFTs, is still composed of cryptonative users trading digital collectibles, not mainstream homeowners buying their house on the blockchain. DeFi, while earning billions in protocol revenue since 2020, has not yet gone to market to the retail mobile banking customer. DAOs remain a rapidly expanding and exciting space, but mostly composed of prototypes and enthusiasts. And web3 is just starting to come to mainstream developer market in the form of alternative web services that are more cost effective, private, and secure.

Over the next decade, CoinFund will continue to work toward bringing some of these incredible technological innovations to broader global markets of users. To do so, we are investing in an incredible team.

Investing in our team

Since 2020, we’ve made a significant investment in our team, which is now over 30 people. On January 1st of that year, Seth Ginns joined us as Head of Liquid Investments and Managing Partner, and in September 2021, managing partners Chris Perkins and David Pakman joined the firm as President and Head of Venture Investments.

Since 2020, we’ve welcomed partners Evan Feng and Austin Barack as our senior investment team members. We’ve made significant hires in our operational teams and back office, and our top-notch operations team has helped us to become a Registered Investment Advisor this year.

Our portfolio companies are first-class citizens at CoinFund. Our team has invested significant amounts of time to work closely with portfolio teams, becoming the first call when something goes wrong, giving them exceptional resources and advocacy. Former CFTC Chairman Chris Giancarlo has joined us as a strategic adviser on regulatory matters, and Chris Perkins has done much work in Washington to give our portfolio companies a voice in U.S. regulatory matters. We also recently hired Margaret Gabriel as Head of Talent to help our portfolio companies strategically invest in and grow their teams, as well as to support our global talent acquisition strategy.

We’re also proud to be living up to our commitment to sustainability, an important topic as blockchains come to market and are regulated. Our partnerships with Apex Group and Nori enabled us to calculate and offset our 2021 bitcoin carbon footprint. Nori finances farmers in states such as Nebraska to use regenerative farming methods that return carbon to the soil, as an alternative to more intensive techniques. We’re also signatories of the 2021 Crypto Climate Accord.

While we may be celebrating our seventh anniversary in similar market conditions to where we started, CoinFund remains bullish on the long-term future of web3. We are continuing to invest with conviction. The staggering progress and growth over the last seven years have laid the foundations for the next era of the open internet. Together with the incredibly talented and multidisciplinary people at CoinFund, we’re proud to be a builder, participant, and backer of this story.

. . .

The views expressed here are those of the individual CoinFund Management LLC (“CoinFund”) personnel quoted and are not the views of CoinFund or its affiliates. Certain information contained herein has been obtained from third-party sources, including from portfolio companies of funds managed by CoinFund. While taken from sources believed to be reliable, CoinFund has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; CoinFund has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by CoinFund. (An offering to invest in a CoinFund fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by CoinFund, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by CoinFund (excluding investments for which the issuer has not provided permission for CoinFund to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://www.coinfund.io/portfolio.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.